E-

Invoicing

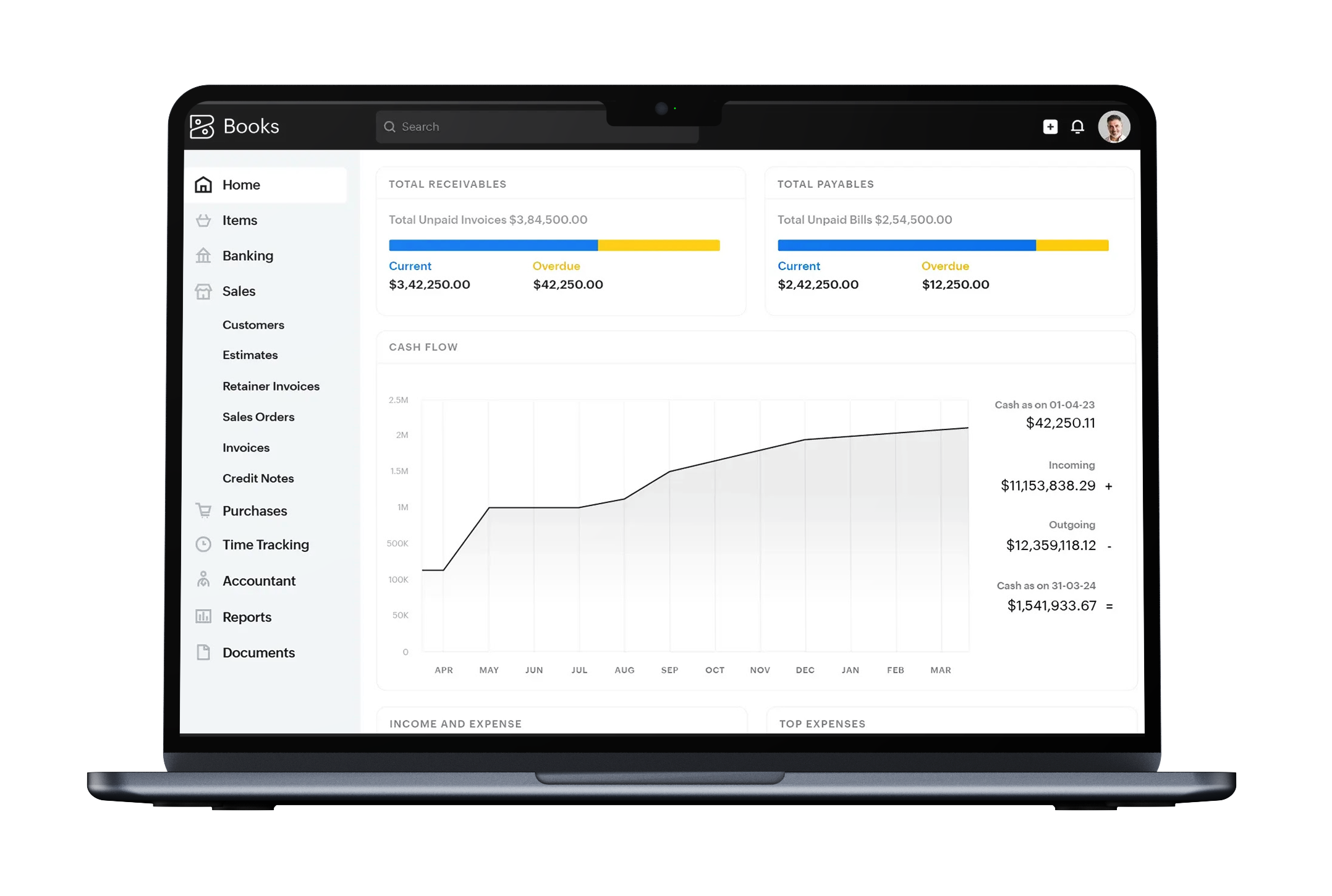

We leverage our custom-built e-invoicing engine, designed to connect seamlessly with virtually any Electronic Billing System (EBS), including platforms like Zoho. This powerful engine ensures efficient and accurate data transmission to the MRA from your existing software, minimizing disruption to your operations.

We handle the complete e-invoicing setup, integration, and ongoing compliance management. By relying on MetaBox, you gain peace of mind, knowing your MRA e-invoicing requirements are expertly managed, allowing you to maintain focus on your core business activities.

User-Friendly

Minimize manual entry, freeing up time for more valuable tasks.

Streamlined Compliance

Meet MRA requirements with ease, staying compliant without the headache.

Future-Ready

Prepare for upcoming mandates and avoid penalties with proactive adoption.

Cost & Environment-Friendly

Save time, reduce errors, and lower costs by eliminating paper-based processes.

Real-Time Financial Insights

Access up-to-the-minute data on invoicing and payments, aiding smarter decisions.

Seamless Integration

Effortlessly integrate e-invoicing with your accounting software for a smoother workflow.

Why delay? get your own now

E-

Invoicing

Efficient Compliance at Enterprise Scale

With high transaction volumes and intricate billing structures, large enterprises benefit the most from early e-invoicing adoption. Stay ahead of compliance mandates and streamline processes with enhanced accuracy and control.Managing complex invoicing for high transaction volumes while maintaining compliance. E-invoicing automates processes, reduces errors, and ensures accuracy across all operations.

Simplified Digital Invoicing for Small Businesses

SMEs can use e-invoicing as a stepping stone for digital transformation. Compliance with MRA’s framework not only simplifies tax processes but also improves transparency with clients and stakeholders. Lack of time and resources to handle evolving tax regulations. E-invoicing simplifies tax compliance, enabling SMEs to focus on growth while avoiding penalties.

Professional Invoicing Made Effortless

Freelancers, lawyers, accountants, consultants, and service providers often deal with clients who expect accurate, compliant invoices. Starting e-invoicing early ensures trust and professionalism in every transaction. Clients demand accurate and compliant invoices for trust and professionalism. E-invoicing ensures quick, professional invoicing tailored to your services.

Fast, Accurate, and Compliant at the Counter

With frequent cash transactions and a need for quick turnaround times, these industries are prime candidates for adopting e-invoicing solutions. Gain speed and compliance, even during peak times. High volume of cash transactions with minimal time for manual compliance efforts. E-invoicing integrates seamlessly into point-of-sale systems for fast, compliant invoicing even during peak hours.

All Businesses, One Framework

At some point, all registered businesses will need to comply. The MRA’s e-invoicing framework is designed to encompass all businesses over time. This phased rollout ensures smoother transitions, but waiting until the last phase may lead to unnecessary penalties, rushed setups, and operational delays.

FAQs

What is E-Invoicing?

E-Invoicing is invoicing, evolved and digitalised. It’s the modern way to detail goods or services provided – creating, sending, and storing invoices electronically through an Electronic Billing System (EBS). It ensures real-time and simplified reporting between the buyer, the seller, and the MRA.

Who is affected by the MRA framework?

The MRA’s phased rollout will eventually apply to all VAT-registered businesses in Mauritius – starting with large enterprises and progressively including SMEs and service providers.

What are the benefits of adopting E-Invoicing early?

Early adoption helps you stay ahead of regulatory deadlines, reduce manual workload, minimise errors, improve transparency with clients and stakeholders, and shows your commitment to digital transformation.

How do I get started?

Getting started is simple. MetaBox listens to your needs, advises you, sets everything up tailored to your business, and ensures you’re fully MRA compliant.

Will E-Invoicing integrate with my existing systems?

MetaBox’s solution is best optimised for integration with Zoho Books. For businesses not using Zoho, we’re open to exploring tailored integrations that suit your existing operations.

How secure is E-Invoicing?

E-Invoicing solutions use advanced encryption, role-based access, and secure data transmission to ensure your financial information stays protected and confidential.

Is E-Invoicing only available on desktop?

No – you can access our E-Invoicing solution across multiple devices, including mobile, so you can manage invoicing anytime, anywhere.

Which other countries use E-Invoicing?

E-Invoicing has already been adopted in countries like Italy, France, India, Australia, and Saudi Arabia, with more joining the global shift toward digital tax compliance.

What happens if I don’t comply by the deadline?

Non-compliance with the MRA’s framework may lead to penalties, billing disruptions, and legal consequences. Acting early ensures a smooth transition and peace of mind.

Is MetaBox part of the list of certified EBS providers in Mauritius?

Yes – MetaBox is officially recognised as an MRA-certified EBS provider in Mauritius, delivering trusted and compliant solutions.

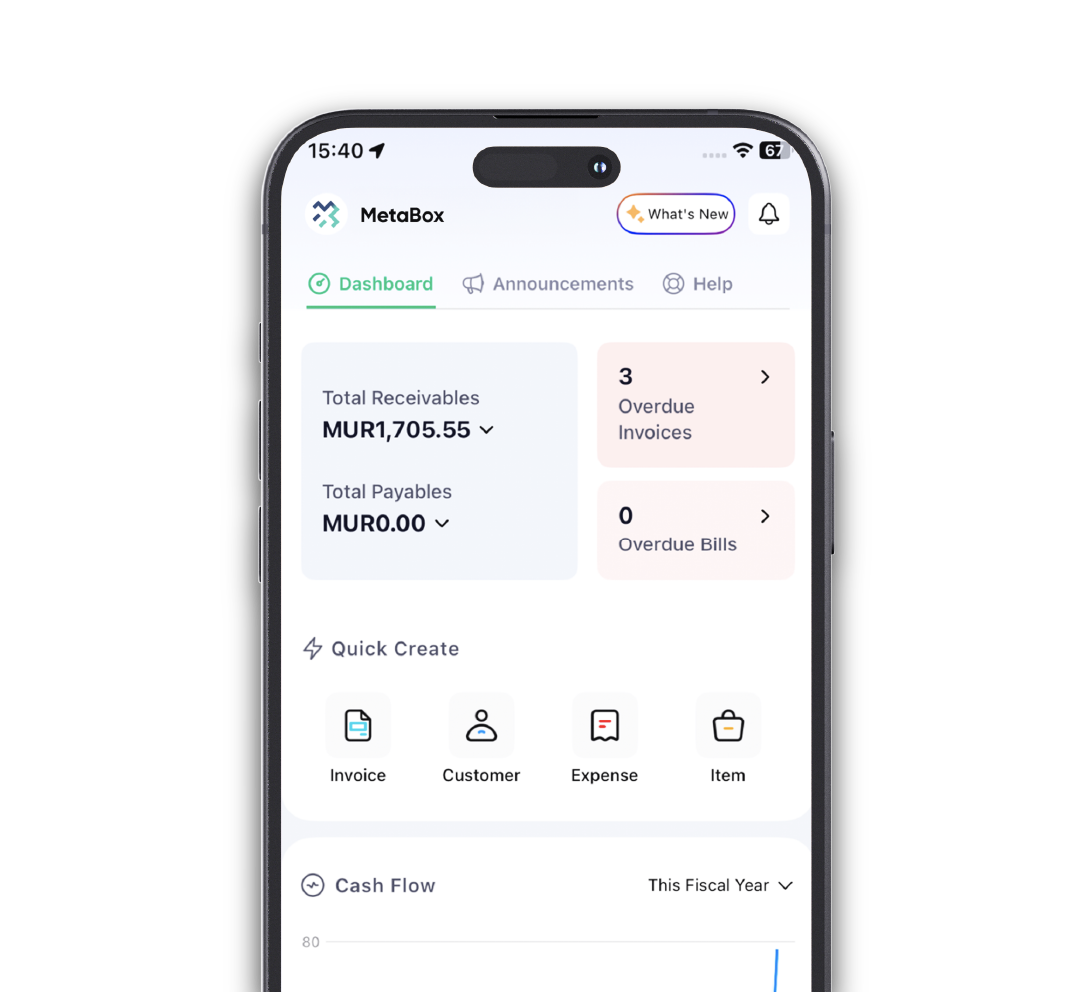

Mobile

App

Stay connected and compliant on the go—submit invoices, track fiscalisation, and more.